Self Clearing Broker Dealer

The low-stress way to find your next self clearing broker dealer job opportunity is on SimplyHired. Independent clearing firms charge fees to their broker-dealer clients for their services.

Client Portfolios Will Dominate Ccp Risk

We offer a full technology stack to facilitate the automatic creation and processing of deal escrows.

Self clearing broker dealer. In fact because LPL is self-clearing you can open 995 of common account types online including most advisory accounts and immediately start performing trades. 70 rows Broker-dealer Clearing firm. The Role and Function of Clearing Firms Between Brokers and Exchanges When an investor buys or sells shares of stock from.

Currently approved for 5 lines of business. Our team has years of experience in private securities and provides efficient. Bank brokerage units whether futures commission merchants FCMs or general clearing members GCMs have been.

When you open an account with a brokerage firm that is a clearing or carrying firm the firm not only handles your orders to buy and sell securities but it also maintains custody of your securities and other assets like any cash in your account. Brokers use them to settle investment transactions. See which clearing firm is used by these brokerages.

Performed the vendor analysis that resulted in a vendor selection for the broker dealer. As a self-clearing brokerdealer your trades are completed quickly and effectively. Several large stock brokers have their own self-clearing firms such as Interactive Brokers Fidelity Wells Fargo ETrade and others.

Self Clearing to Introducing Broker-Dealer. LPL Investment Holdings Inc. Many of the larger brokers have realized they can save the fees and handle the clearing function in house.

Middle-office teams have traditionally opted to self-clear when a market is strategically important to the firm or when the number of clearing brokers offering services in that particular market is very limited. In fact because LPL is self-clearing you can open 995 of common account types online including most advisory accounts and immediately start performing trades. If the brokers are self-clearing they can cut costs and in turn offer customers lower transaction fees.

Self Clearing Brokerage Firms 2021 List of self clearing online brokers. Established in 2012 Completely clean broker dealer for sale. Verus Consulting is highly experienced in migrating firms to a fully-disclosed status.

Clients of large banks are turning to self-clearing as capital constraints and lack of returns forces banks to downsize their clearing businesses according a recent whitepaper authored by derivatives technology specialist Contango. 107 self clearing broker dealer jobs available. A clearing firm or self-clearing firm may enter into an agreement with a third party pursuant to which the third party agrees to fulfill the obligations of a clearing firm or self-clearing firm.

Many went into operation on a fully-disclosed basis relying on clearing firms to take on a large portion of the technology requirements compliance and reporting duties and financial responsibilities. A clearing broker helps to. Additionally a self-clearing model enables a broker-dealer to maximize their revenue opportunities and often times reduce costs Broadridges consolidated business process outsourcing BPO services support self-clearing through a combination of global asset servicing client reporting reconciliation and clearance and settlement for all product classes said Barra.

As a self-clearing brokerdealer your trades are completed quickly and effectively. North Capital Private Securities is a self-clearing broker-dealer approved to provide escrow services for offerings under Reg D Reg A Reg S and Reg CF offerings. Introducing to Self Clearing Broker-Dealer.

That is both the execution and clearing. A Each member that is a clearing firm or self-clearing firm shall be required to report to FINRA in such format as FINRA may require prescribed data pertaining to the member and any member broker-dealer for which it clears. A clearing firm does not always have to be a third party.

Approved for up to 15 registered persons. Private placements PLA Mutual Fund Sales MFR Selling Group Participant Best Efforts MA Advisory and Variable Life Sales VLA. Private Placement Broker Dealers.

Self Clearing the vast majority of large brokers self-clear their trades. Thorough understanding of the requirements for becoming a self-clearing brokerdealer. A clearing broker dealer is a financial industry professional who serves as the go-between for brokers often known as introducing brokers and.

The challenge with maintaining connectivity is that firms must not only. Independent Broker Dealer Firms. John Phillips EVP head of broker-dealer.

Self Clearing Broker Dealers. All trades and operations are processed in a single location eliminating third-parties and reducing. 1 Someone looking to buy a broker-dealer such as.

These brokers may create a subsidiary to self-clear their own customers trades savings that may or may not be passed. 3 An investor searching for producing Broker-Dealers to. Engaged in and supported a vendor search for US broker dealer securities processing technology platform.

A clearing broker is a member of an exchange that acts as a liaison between an investor and a clearing corporation. Completed and filed the US broker dealer Clearing Member Application for self-clearing approval. Fidelity Clearing Custody Solutions.

Principal willing to stay on through the transition. 2 An owner seeking a merger acquisition of a broker dealer. With an introducing firm the brokerage firm accepts your ordersbut it will have an arrangement.

Engaged to help a US broker dealer move to self-clearing. Fidelity Investments Ally Wellstrade IB Robinhood Firstrade M1 Finance and TradeStation. In many cases the largest clearing firms handle a large number of transactions from various broker-dealers each day.

That is both the execution and clearing of trades are done by the same firm. See salaries compare reviews easily apply and get hired. One challenge to overcome is the realities of the digital broker-dealer business model.

There are two types of clearing firms independent and self-clearing broker-dealers. However its important to note that some brokers are self-clearing meaning that they have their own clearing firm while others use a third party to clear the transactions.

What Are Clearing Firms And Why Do They Matter

What Are Clearing Firms And Why Do They Matter

Pdf Download Finance For Nonfinancial Managers By Gene Siciliano Free Epub Accounting Books Finance Free Books Online

Broker Clearing House Charles Schwab Vanguard Etrade Ib Ally

What Are Clearing Firms And Why Do They Matter

Gold Eagle Mt5 Free Download And Review Forex Software In 2021 Forex Gold Eagle Advisor

What Are Clearing Firms And Why Do They Matter

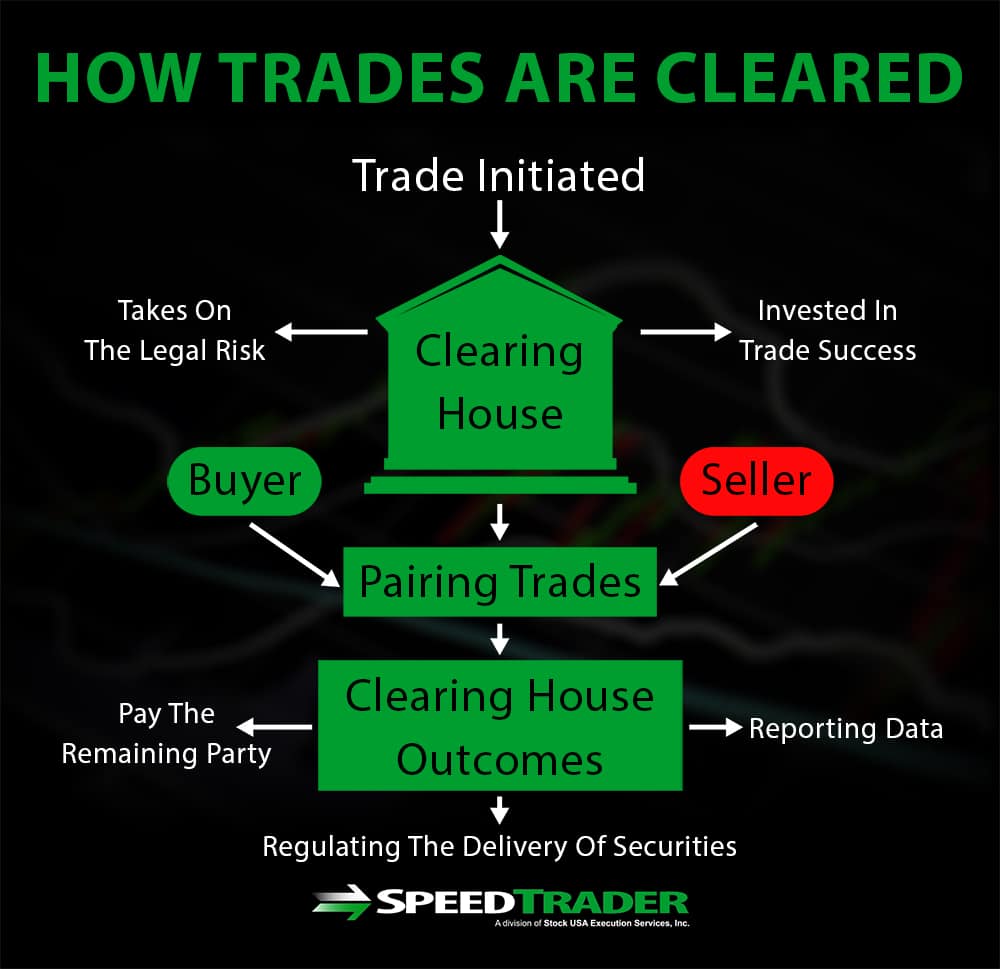

What Is A Clearing House And How Does It Affect Your Trades

Letters Of Guarantee Templates Beautiful Letter Of Guarantee 10 Samples For Word And Pdf Letter Writing Template Lettering Resignation Letters

To Self Clear Or Outsource 5 Factors To Consider Accenture Capital Markets Blog

The Self Clearing Broker Dealer Advantage Lpl Financial

Pin By David G On Kimunye Fund Management Legal Activity Company Names

How To Replace Lost Knec Certificate National Examination Chemistry Paper School Certificates

Pt Solid Gold Berjangka Cabang Semarang

Choosing A Clearing Broker One Of The Most Important Decisions For By Daniel Aisen Proof Medium

Choosing A Clearing Broker One Of The Most Important Decisions For By Daniel Aisen Proof Medium

:max_bytes(150000):strip_icc()/GettyImages-686726405-c18a06deabe946f094ccef37bd054eda.jpg)

Post a Comment for "Self Clearing Broker Dealer"