George Soros Trading Style

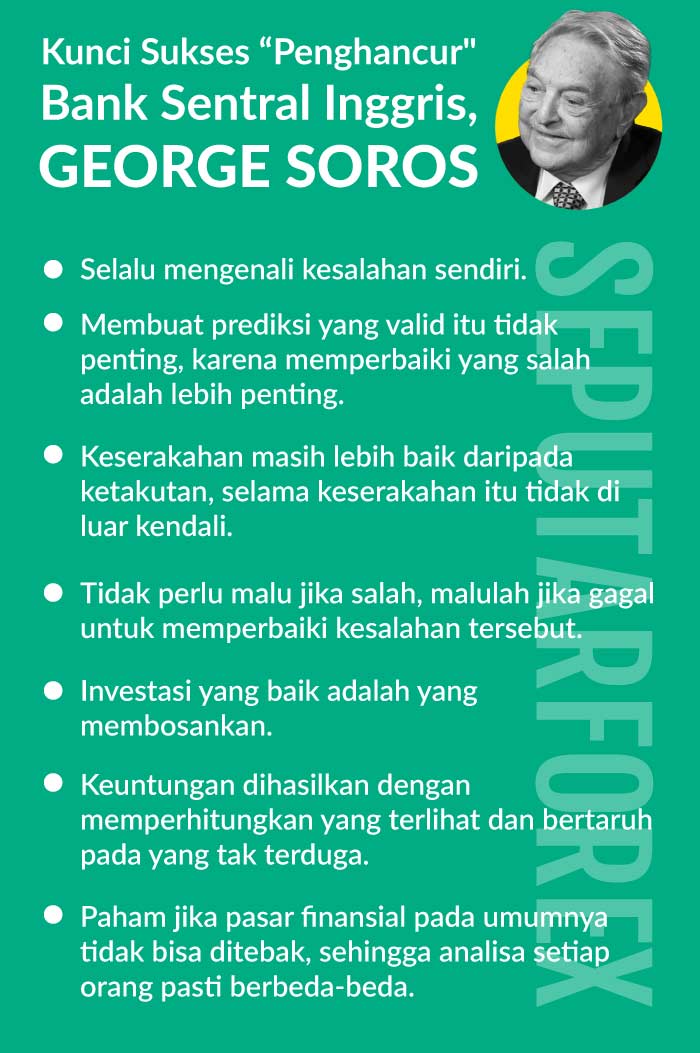

George Soros likely uses some form of reactive analysis to tell him in which direction to take a trade based on how a scenario or price action markets unfolds. George Soros understands that a trader doesnt have to have more wins than losses to be profitable.

George Soros Forex Trader Trading Strategy System Scalping Robot Indicator Youtube

It is our style of making money.

George soros trading style. George Soros is the man who broke the Bank of England the same man who speculated 10 billion on a single currency by shorting the British Pound which proved correct and made him earn 1billion in a single day. We are not doing this as a public service. Therefore we tend to stabilize rather than destabilize the market.

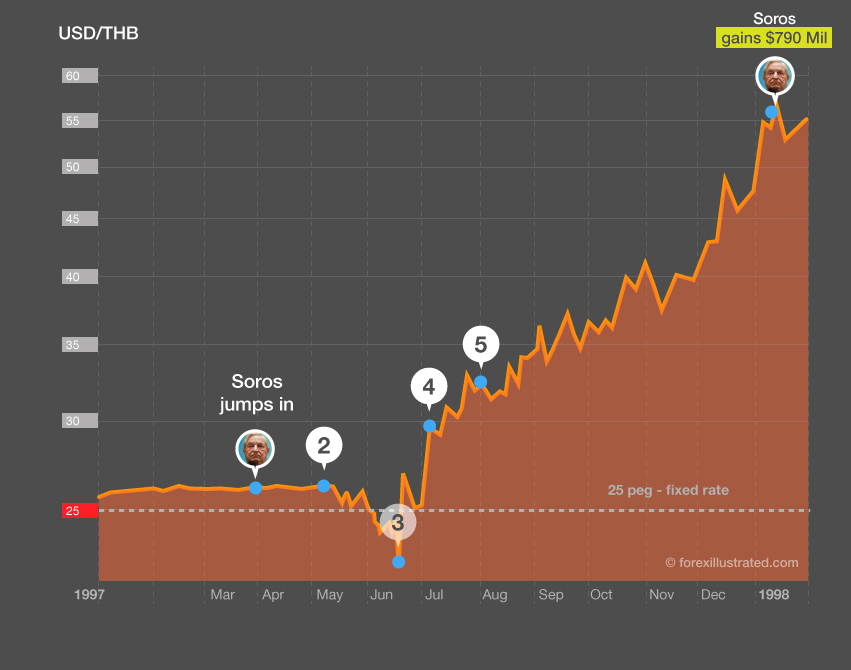

George Soros 13F portfolio value increased from 533B to 593B this quarter. His hedge fund is known for its global macro strategy a trading style centered around making large bets on the movements of currencies commodity prices stocks bonds and etc all based on macroeconomic analysis. The second most notorious trade of Soros came in 1997 when he saw a possibility that the Thai baht could go down.

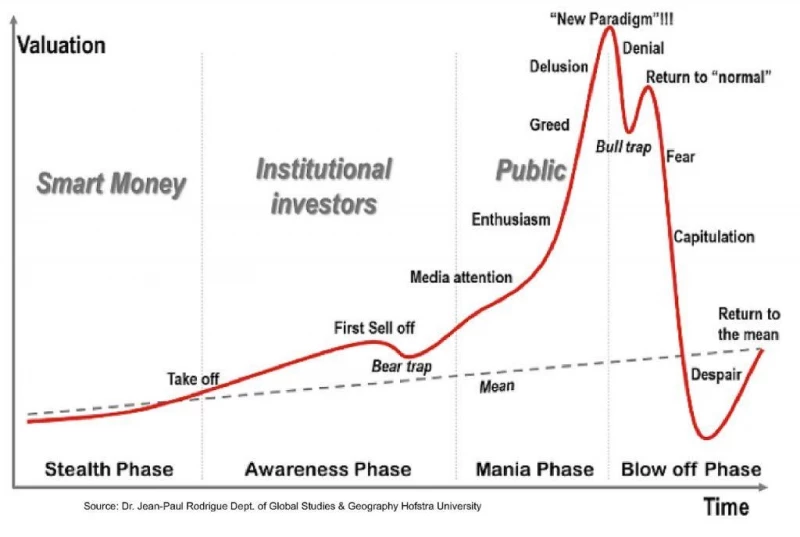

The market plays on the psychology of investors. He may short the stock or buy a put option. This particular one explains the theory of reflexivity which is the theoretical foundation George Soros uses to analyze markets.

However there are some aspects of Soros trading that investors generally can learn from. George Soros will also short sells stocks when their earnings are expected to disappoint. George Soros is known for trading with the trend until the end when it starts to bend.

Soros speculated that the Thai Baht would decline and he placed buy trades on the USDTHB pair meaning he was shorting the Thai baht. In some cases his massive positions earned him billions of dollars. Mastering trading psychology greed fear is very important to the long-term success of traders.

His basic belief is that markets are wrong but will go with trend and is. The Soros Style. George Soros trading philosophies.

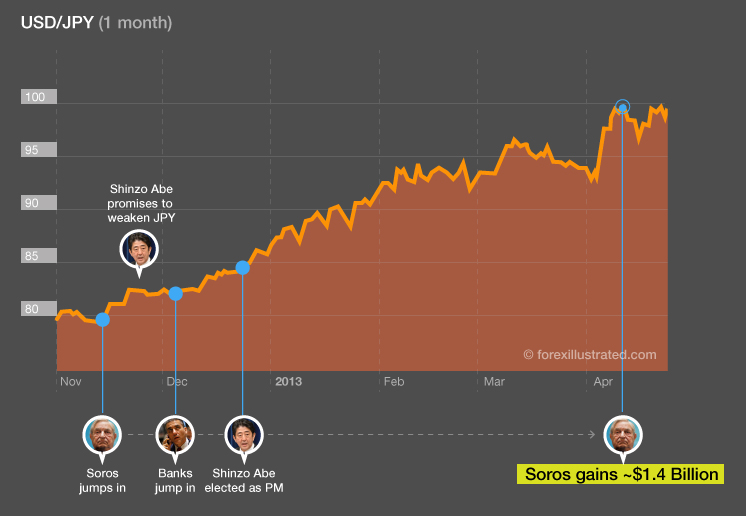

The stock currently trades at 143 and the stake is now. The trades against the Bank of England Bank of Thailand Bank of Japan and the events of 1987 showcase Soros trading style from several different angles but they all showcase the same trading mentality. So lets dive into them right away.

We are not doing this as a public service. We are not doing this as a public service. Simply put in Soros theory the thinking.

Investing and Trading Strategies by George Soros Here are some of the strategies that George Soros used to invest his money. Here we are trying to understand the 10 Forex trading rules and strategy of George Soros. So he went short on the baht by going long on USDTHB using forward contracts.

Therefore we tend to stabilize rather than destabilize the market. George Soros rejects the idea of technical analysis that all fundamentals are immediately reflected in the price and contents that investors and traders distort the fundamentals by their individual biases. I had misplaced my copy of Robert Slaters 1996 biography of George Soros so I welcomed the opportunity to get my hands on Slaters recently released second edition entitled.

As long as the money you make when you are right is more than the amount you lose when you are wrong you will be profitable. It is our style of making money. Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected.

It is our style of making money George Soros trades with the trend until the end when it. Unfortunately the more complex the system the greater the room for error. First Soros stood by his trades.

Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected. John Wiley has just brought out a new edition of The Alchemy of Finance that includes Soros most recent writings on this method. In addition Soros style of making highly leveraged highly speculative bets does not offer specific patterns that most traders can follow.

In describing his firm Soros said we try to catch new trends early and in later stages we try to catch trend reversals. The main takeaway from all of these cases is that Soros cared more about the risk-reward profile than anything else. George Soros makes good use of value investing tactics and can have a contrarian view.

The next notable trade which brought in more than half a billion in profits for George Soros was during the Asian financial crisis in 1997. To learn about Soros distinct trading style and. George Soros Quotes On Trading And Forex.

If there is one thing we can say to summarize George Soross trading success its that he developed his trading abilities so acutely that he had no-fear of taking any trade and we can see the pay-off of such an ability in his famous billion-dollar win shorting the British pound. We try to catch new trends early and in later stages we try to catch trend reversals. His actions were often considered a triggering factor which resulted in the big Asian financial crisis that affected not only Thailand but also South Korea Indonesia Malaysia Philippines Hong.

George Soros became one of the most well-known currency traders in the world one day in 1992.

Trading Strategies 3 Biggest Step By Step Forex Trades Of George Soros Forex Illustrated

Soros Channel On How To Trade Forex Using Day Trading Strategy Youtube

5 Tips Trading Dari Trader Forex Legendaris George Soros Broker Forex Terbesar Indonesia Mifx

George Soros Forex Trading Strategies Forex Ea Generator 6 Tutorial

10 Aturan Trading Inspiratif Dari Kutipan George Soros Artikel Forex

Forex Trend Trading George Soros Technique To Trade Market Reversals Gbp Analysis Youtube

George Soros Forex Trading Strategies Forex Scalping With Bollinger Bands

3 Little Pigs Trading Strategy Weekly Report 12 May 13 Forex Useful

George Soros Forex Trading Strategy Unbrick Id

Macro Ops Unparalleled Investing Research

Trading Strategies 3 Biggest Step By Step Forex Trades Of George Soros Forex Illustrated

Macro Ops Unparalleled Investing Research

Top 7 Best Day Traders In The World What S The Key To Their Success Forex Trading Wiki

George Soros Forex Trading Techniques Forex Robot With Stop Loss

Macro Ops Unparalleled Investing Research

Stochastics George Soros Closet Technician Traders Com Advantage

10 Things You Can Learn From The World S Best Traders Learn To Trade The Market

Post a Comment for "George Soros Trading Style"